Fixed term mortgage calculator

Break fee 300000 x 2 years x 1. This mortgage calculator is a well-equipped loan calculator that deals with multiple.

30 Year Mortgage Rates Calculator Clearance 57 Off Www Ingeniovirtual Com

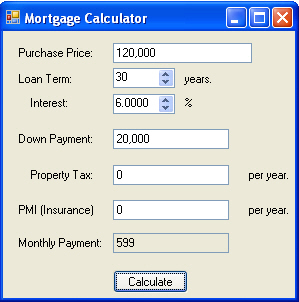

Private mortgage insurance rates are typically 05 to 10 of the value of the mortgage.

. Usually one can take a loan for up to 20 or even 30 years but some mortgages might last for 40 or 50 years. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Mortgage rates valid as of 12 Sep 2022 0248 pm.

We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

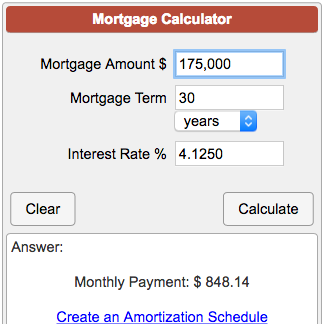

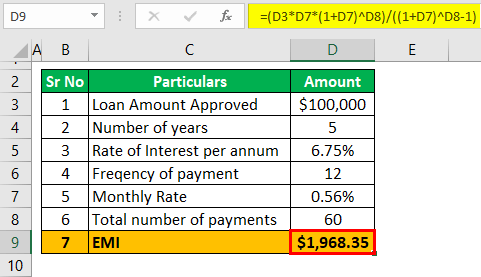

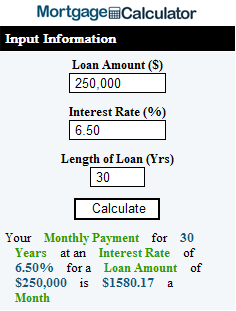

Select your loan term from the drop-down menu. Input the interest rate you expect to pay on your mortgage. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

The most common mortgage terms are 15 years and 30 years. You can pay off a mortgage while in a fixed rate to own your property outright but your lender is likely to request an early. By default 250000 30-yr fixed-rate loans are displayed in the table below.

The term of the loan can affect the structure of the loan in many ways. To use our mortgage calculator slide the adjusters to fit your financial situation. Conforming loans have a price limit set annually with high-cost areas capped at.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. See todays 30-year mortgage rates. After choosing either a fixed rate mortgage or an ARM you will also need decide which loan product is right for you.

Fixed rates stay unchanged for a set term usually two five or ten years. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Todays mortgage rates in Florida are 6093 for a 30-year fixed 5197 for a 15-year fixed and 5372 for a 5-year adjustable-rate mortgage ARM.

In both cases the plans allow you to establish a line of credit and receive fixed monthly payments for either a specified amount of time or for your lifetime in your home. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage. Refinancing your home loan to a fixed-rate mortgage offers you consistency that can help make it easier for you to set a budget.

Check out the webs best free mortgage calculator to save money on your home loan today. A loan term is the duration of the loan given that required minimum payments are made each month. Our calculator includes amoritization tables bi-weekly savings.

Fixed-rate mortgage have shorter terms than variable rate. Filters enable you to change the loan amount duration or loan type. Mortgage rates valid as of 31 Aug 2022 0919 am.

This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage. Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home. The loan term influences mortgage conditions.

There are also optional fields including annual taxes home. Todays mortgage rates in Georgia are 5972 for a 30-year fixed 5196 for a 15-year fixed and 5469 for a 5-year adjustable-rate mortgage ARM. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Getting ready to buy a home. But once that term expires your lender will put you on their standard variable rate which is much higher. With both term and tenure payment options you also have the choice to do a modified termline of credit plan or a modified tenureline of credit plan.

Youll get charged an early repayment fee if you decide to pay off your mortgage during the fixed-rate term. A mortgage in itself is not a debt it is the lenders security for a debt. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Our Mortgage APR is for fixed rate loans and does not give an accurate comparison of the costs on adjustable-rate mortgages ARMs because it cannot anticipate how the rate on the loan may change over time. The loan term and the interest rate.

Scroll down the page for more detailed guidance on using this mortgage calculator and frequently asked. The number of years over which you will repay this loan. The loan term represents the number of years itll take you to repay your mortgage.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Getting ready to buy a home. Your mortgage interest rate and your total monthly payment of principal and interest will stay the same for the entire term of the loan.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. If you prefer predictable steady monthly payments a 30-year fixed. Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage.

Fixed-rate mortgages also tend to be less flexible. Paying off a fixed-rate mortgage early. Generally the longer the term the more interest will be accrued over time raising the total cost of the loan for borrowers but reducing the periodic payments.

You can read more about this including how to refinance a fixed-rate mortgage and how a broker can help you out in our guide to remortgaging a fixed-rate mortgage early. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Remember paying a break fee isnt always bad you either pay the cost as a lump sum or you pay a higher rate of interest for the fixed-rate term.

The longer the duration the less you. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Most homebuyers choose the 30-year fixed loan structure.

A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Break fee Loan amount x Remaining fixed term x Change in cost of funds.

Use the mortgage break fees calculator to estimate your home loan exit fees. 30 Year Fixed Rate. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford.

Interest Only Mortgage Calculator

Mortgage Calculator Money

5 Alternative Ways To Use A Mortgage Calculator Zillow

Adjustable Rate Mortgage Calculator Step By Step

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Mortgage Calculator How Much Monthly Payments Will Cost

Downloadable Free Mortgage Calculator Tool

Reverse Mortgage Calculator How Does It Work And Examples

Free Interest Only Loan Calculator For Excel

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Loan Originator Mortgage Infographic

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

5 Year Fixed Mortgage Rates And Loan Programs

Mortgage Calculator Script Free Mortgage Calculator Widget

Mortgage Calculator In C And Net

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Va Mortgage Calculator Calculate Va Loan Payments